Autumn is back to school season, and while some people might think about tailgating at football games, there is another competition that takes place on campuses every fall, colleges report their investment returns. While FoundationAdvocate’s (“FA”) focus is the private foundation universe, we are keenly interested in their nonprofit cousins, college endowments. Unlike most foundations, colleges typically publish their investment returns (an excellent summary table from Pensions & Investments can be found here). Additionally, some colleges disclose asset allocations, lay out their investment strategies, and discuss expectations providing FA with interesting views into the mindset of institutional nonprofit investing.

Oops, We Did it Again

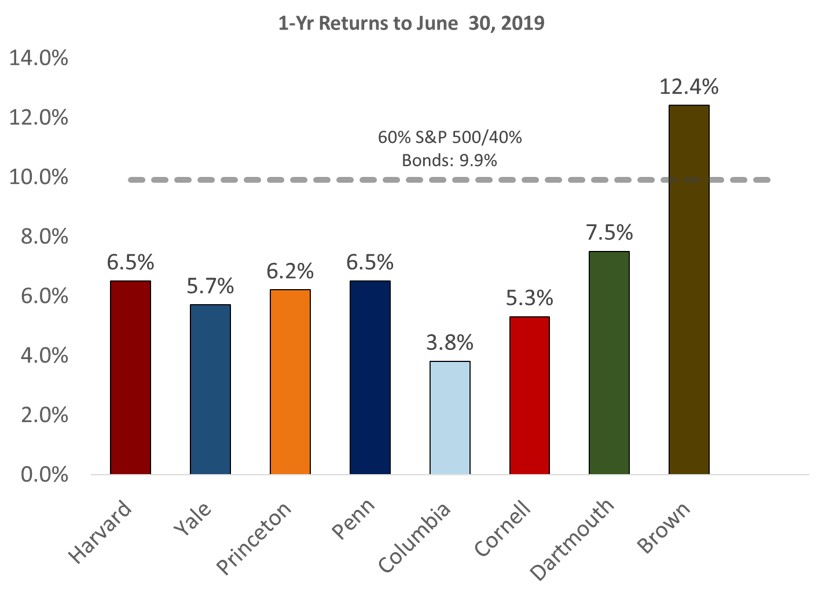

Once again, most college endowments trailed a simple balanced portfolio comprised of 60% stocks (S&P 500) and 40% bonds (Bloomberg Barclays U.S. Aggregate) which returned 9.9% for the year ended June 30, 2019. The Ivy League results (in charts below ranked by asset level left to right) are indicative of the overall endowment universe which, according to preliminary results from Cambridge Associates, returned about 5% for the year ended June 30, 2019. Ten year returns show similar results with just two Ivies, Yale and Princeton, beating the 60/40 mix.

What's Causing The Under-Performance?

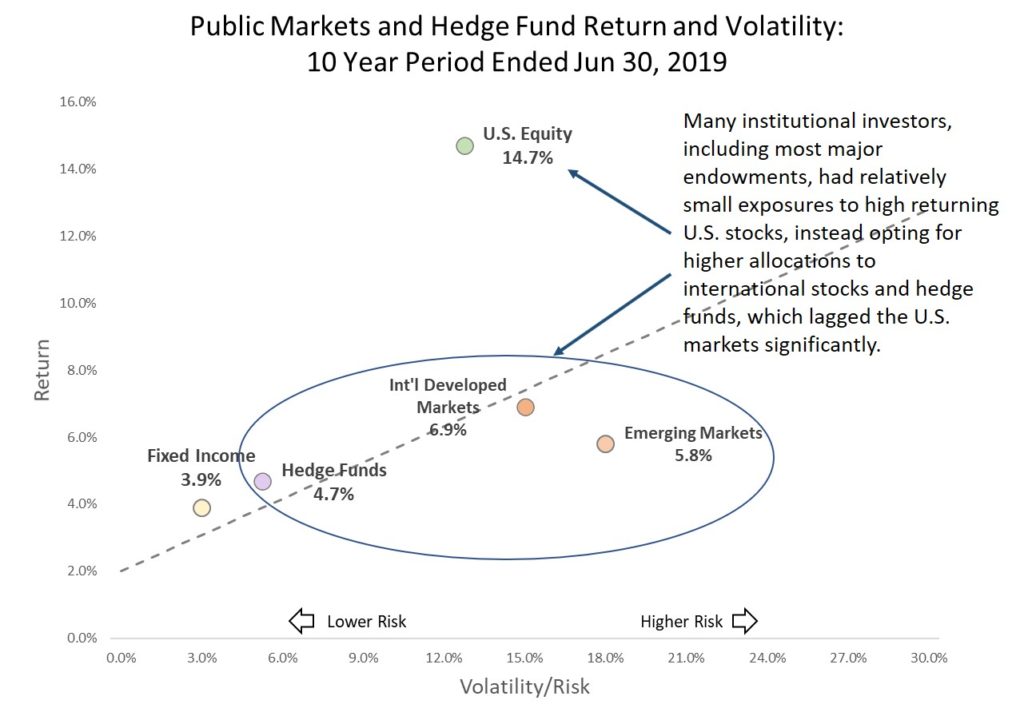

For many large institutional investors, including most endowments, their under-performance can likely be traced to two decisions, 1) over-weighting international stocks versus U.S. shares, and 2) maintaining a large exposure to hedge funds, which haven’t fared well over the last decade.

The chart below shows U.S. equities (S&P 500) returned 14.7% per year over the 10 year period, more than double the return of international developed markets 6.9%, and close to 9% per year better than emerging markets. Furthermore, U.S. stocks were less volatile/lower risk than their international counterparts.

Hedge funds were up 4.7% on an annualized basis for the period, which while better than bonds, was significantly below expectations for the asset class.

So Where Does This Leave Endowments?

In our piece The Endowment Model: A Brief Overview, we lay out the basic thesis behind the “endowment” or “Yale” model of investing. Many institutions and consulting firms adopted the strategy in hope of replicating Yale’s success. However, as we saw from the Ivy League 10 year return numbers, the strategy hasn’t lived up to its promise of late. Reconciling the difference between actual results versus expectations leads to one of two primary possibilities. either:

- The “endowment” model is sound and 10 years period isn’t “long term” enough ( let’s call this the reversion to the mean group).

Or

- Some assumptions in the “endowment” model need to be revisited.

The emergence of the “endowment” model was an incredibly lucrative innovation for early adopters. Twentysome years later, trustees must ask themselves, if they are still believers (reversion school) or if they should be reconsidering other strategies.