By

The first thing you should know about foundations is that there are a lot of them – over 100,000 in the United States (there are a handful of foundations outside the U.S., but as the distinguishing characteristic is the exemption from US taxes, there isn’t much reason to file U.S. forms). Our work focuses on those foundations with over $1 million, of which there are over 40,000. To put that number in context, there are fewer than 2,000 colleges and universities in the U.S., and so there are 20 times more foundations than there are colleges.

In contrast to colleges, which have about $600 billion in assets, foundations have over $1 trillion in assets. Foundations provide nearly $75 billion in charitable giving every year, accounting for 18% of all philanthropic support.

With some exceptions, for the most part, foundations provide financial support to operating charities. When asked to name foundations, most people’s defaults are the largest and best known names such as Gates, Ford, Rockefeller, and Carnegie, all of which bring to mind images of large institutional organizations. However, many are surprised to learn that more than 80% of foundations have no offices and no employees; rather, they are investment portfolios whose purpose is to fund operating nonprofits.

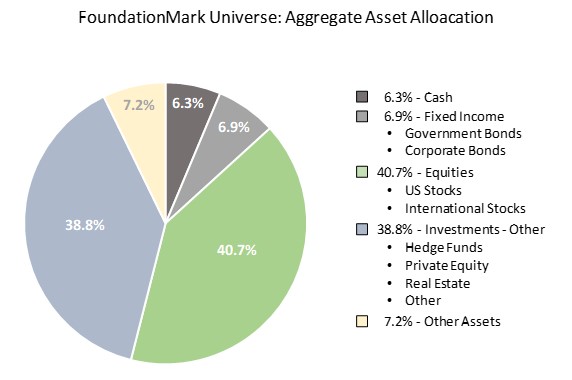

If asked to describe an investment portfolio, you might reply that it’s a collection of assets, such as stocks, bonds, perhaps some hedge funds, private equity, or real estate, that are combined to generate investment returns. The balance sheets of foundations represent a large group of investment portfolios.

Of course, investment portfolios are designed to generate investment returns. In the case of foundations, these investment returns provide the engine that powers their grant making. Investment returns have a direct, meaningful, and measurable effect on foundations’ ability to maintain or increase their levels of giving. Put simply, better returns mean more money sent to charitable endeavors.

At FoundationAdvocate, we applaud all foundations for their philanthropy. However, recognizing that better returns lead to greater support, we also view them through an investor lens, and encourage others to do so as well.

The more successful foundations are as investors, the greater impact they can make on important causes.

Interested in a free FoundationMark report on your foundation’s investment performance? click here

E-Mail: info@FoundationAdvocate.com