trest

Performance

Disbursements Forecast Update: June 2024

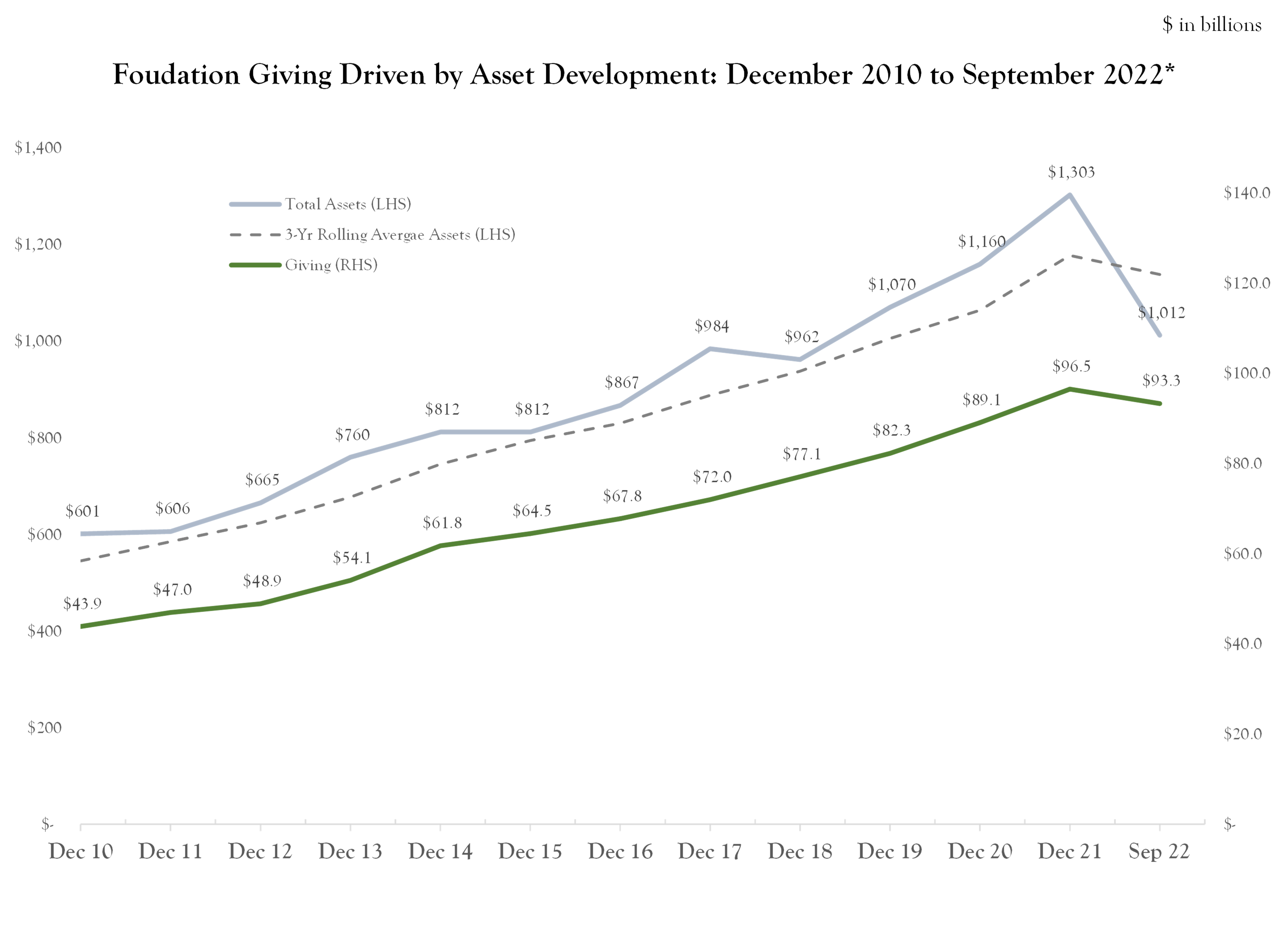

Disbursements Projected to Increase 6.6% in 2024 Disbursement projections are a function of two variables; 1) asset level, and 2) payout ratio. Estimated June 2024 foundation assets reached a record $1.6 trillion, up nearly $280 billion from 2022.Based on the two important caveats (see box) regarding asset levels and payout ratios that we highlight, we project foundation … [Read more...] about Disbursements Forecast Update: June 2024

Second Quarter Investment Performance

Foundations Notch a 6.6% Investment Gain in First Quarter The Grantmaker Investment Value Index ("GIV") rose 2.6% in the second quarter and 9.4% for the year-to-date. Foundation investment performance annualized at 6.8% per year for the ten years ended June 30, 2024, ahead of the required 5% payout ratio, but not after accounting for inflation and still well below the 60/40 … [Read more...] about Second Quarter Investment Performance

Solid Second Quarter

FoundationMark models indicate that U.S. foundations' assets rose by nearly $120 billion, or about 8.0%, in the first half of 2024 pushing assets to almost $1.6 trillion.Foundation asset levels are a function of three variables: incoming contributions, outgoing grants and expenses, and investment performance. The Grantmaker Investment Value ("GIV") Index was up 9.4% in the … [Read more...] about Solid Second Quarter

Disbursements Forecast Update: March 2024

Disbursements Projected to Increase 5.3% in 2024 Disbursement projections are a function of two variables; 1) asset level, and 2) payout ratio. Estimated March 2024 foundation assets reached a record $1.55 trillion, up $230 billion from 2022.Based on the two important caveats (see box) regarding asset levels and payout ratios that we highlight, we project foundation … [Read more...] about Disbursements Forecast Update: March 2024

First Quarter Investment Performance

Foundations Notch a 6.6% Investment Gain in First Quarter The Grantmaker Investment Value Index ("GIV") rose 6.6% in the first quarter, continuing the upward trajectory after 2023's 15.5% gain. Foundation investment performance annualized at 6.8% per year for the ten years ended March, 31 2024, ahead of the required 5% payout ratio, but not after accounting for inflation … [Read more...] about First Quarter Investment Performance