Footer

Are you a trustee?

Interested in a free FoundationMark report on your foundation’s investment performance? click here

Contact Details

E-Mail: info@FoundationAdvocate.com

By

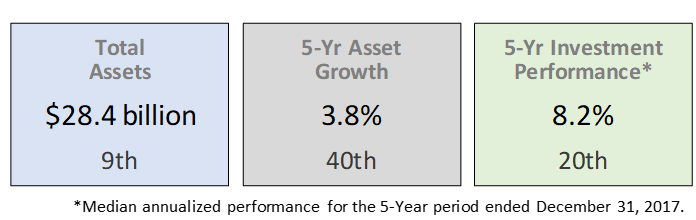

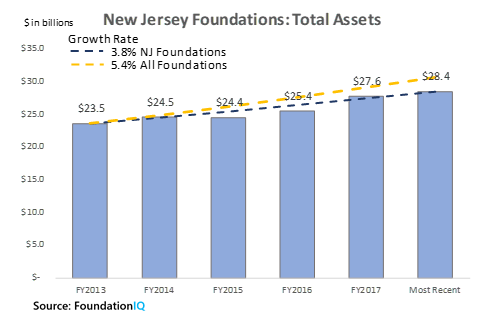

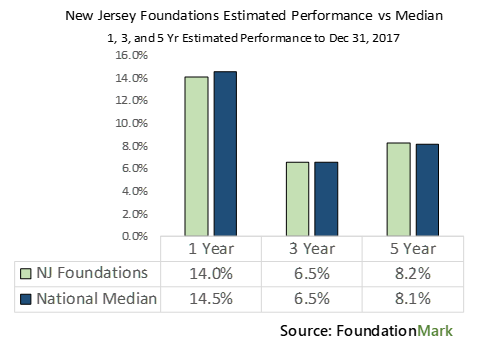

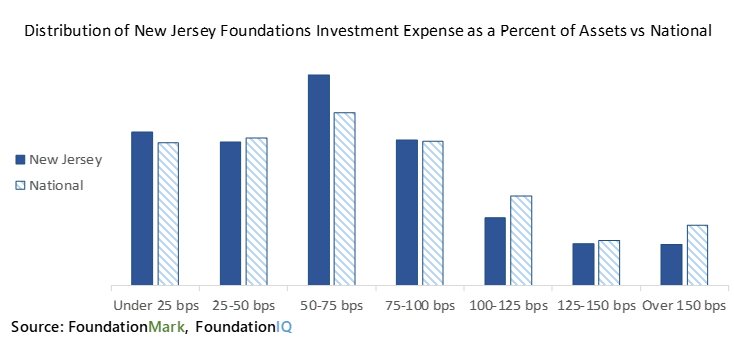

All data used in rankings and calculations is provided by FoundationMark and FoundationIQ and reflects foundations with over $1 million in assets.

The chart blow shows the distribution of New Jersey foundations fees versus the national average – New Jersey had a higher proportion in the 50-75 basis point range and were generally better across the board (more lower – shown on left, less higher – shown on right),

Basis Points (bps): Investment fees are usually quoted as a percentage of assets. For example an investment manager may charge a 0.75% fee to manage the money that you have with the firm. The term ‘basis point’ is an easier way to say small numbers by moving the decimal point two places to the right. so 0.75% = 75 basis points, for the simple reason it is easier to say out loud “seventy five basis points” than “zero point seven five percent”.

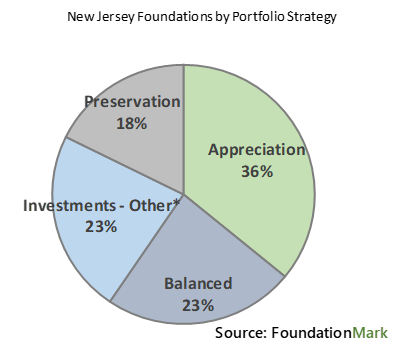

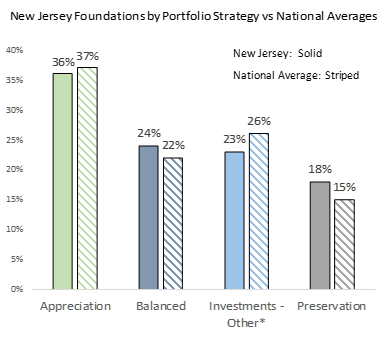

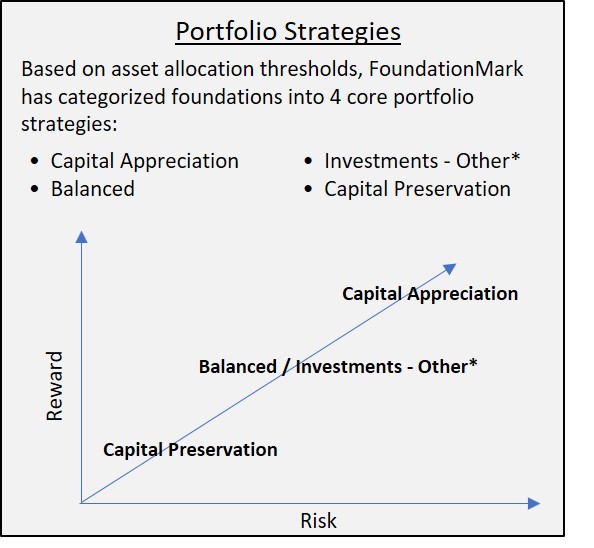

FoundationMark Portfolio Strategies

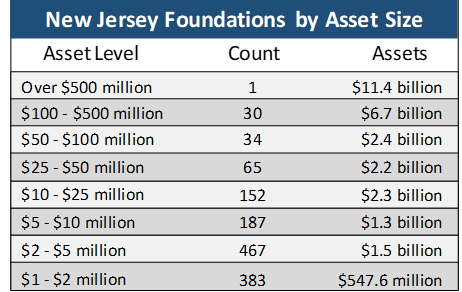

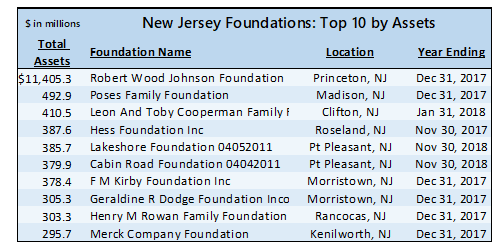

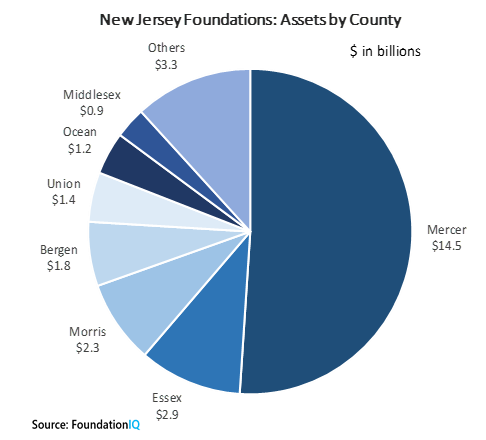

About 1,300 New Jersey foundations have assets in excess of $1 million.

If you would like to learn more about the over 1,310 foundations in New Jersey with over $1 million in assets, or the other 40,000 foundations outside of New Jersey that we track, including performance and expense data, please visit our affiliated companies:

Interested in a free FoundationMark report on your foundation’s investment performance? click here

E-Mail: info@FoundationAdvocate.com