By

Investments – Others*: There is a distinct line on the IRS form requiring the fair market value of a foundation’s holdings in ‘Investments – Other’, which may include hedge funds, private equity, commodities, and other investments. Foundations with over 60% of their assets in ‘Investments – Other’ are classified by portfolio strategy with asset class name.

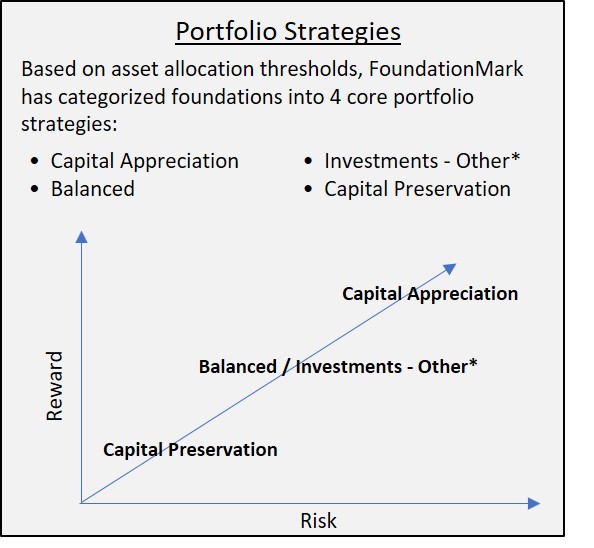

Asset Allocation Thresholds

Interested in a free FoundationMark report on your foundation’s investment performance? click here

E-Mail: info@FoundationAdvocate.com