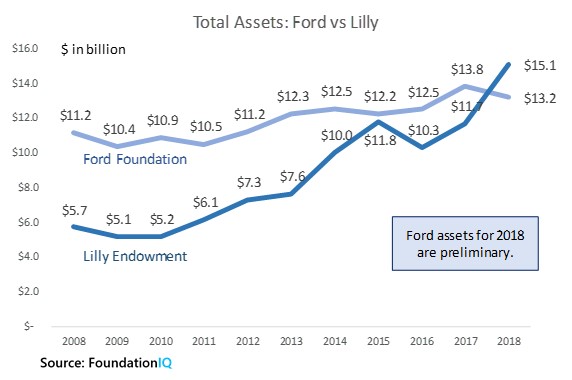

This summer we wrote that we believed that the Lilly Endowment would overtake the Ford Foundation in terms of assets, making Lilly the second biggest foundation in the U.S. Our thesis was confirmed recently as Lilly reported total assets of $15.1 billion in its 2018 filing and Ford provided indications that 2018 total assets would come in about $13.2 billion in its 2018 financial snapshot.

Ford changed its fiscal year in 2012, so prior years reflect a September 30th year end.

As one can see from the chart above, Lilly was about half the size of Ford 10 years ago, but since then Lilly’s assets have nearly tripled to over $15 billion as the endowment is essentially entirely invested in Eli Lilly & Co. stock (NYSE:LLY), which has done exceedingly well. The Ford Foundation has a more diversified portfolio consisting of public securities and alternative investments such as private equity and hedge funds. Over the 10 year period, Ford was able to grow its assets from $11.2 billion to over $13 billion, despite paying out about $7 billion in grants and operating expenses, which is quite a feat.

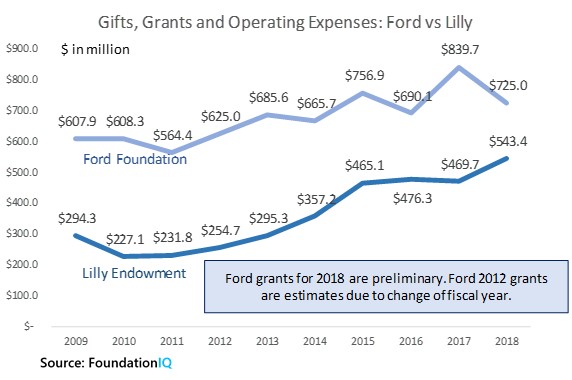

Better investment performance isn’t about bragging rights, it is about something far more important, philanthropic support. The chart below shows that since 2010/2011 Lilly’s annual gifts, grants, and operating expenses have increased by over $300 million from the $220-$230 million range to nearly $550 million and growing. Over the same period, Ford has been able to increase its support, from the $600 million range to the $750 million range, an increase of about 25%.

As one can see from the charts above, investment performance has a direct, meaningful, and measurable impact on the amount of money foundations have to support important causes.

It bears noting that, while Lilly’s investment performance is enviable, putting all your eggs in one basket is not typically an investment strategy that is widely embraced, and carries a good deal of risk. Foundations must assess their funding goals and risk tolerances when constructing an investment strategy. FoundationAdvocate does not endorse or advise on investment decisions, but we do encourage active discussions on what foundations might be able to learn from one another to improve overall performance and boost charitable support.

Will Lilly Stay on Top?

Through September, Lilly’s share price is about back to where it began the year while global equity and fixed income markets have fared much better. Therefor, it is likely that Ford has picked up some ground on Lilly, but we won’t know for certain until the end of year at earliest if Lilly has maintained second place for 2019.

Whether or not Lilly stays ahead of Ford isn’t really the issue. We prefer to focus on the fact that Lilly and Ford have increased their philanthropic support by $300 million and $150 million per year, respectively over the past decade, due in a large part to investment performance. Foundations’ returns and assets all go to funding charitable work, either today or in the future, and as we have shown, investment returns can play a major role in determining funding levels. The relationship between returns and giving exists across all asset levels, not just the very largest ones. Whether a foundation is making $25 thousand or $25 million a year in grants, a major factor in its ability to maintain or increase funding level is its investment performance.