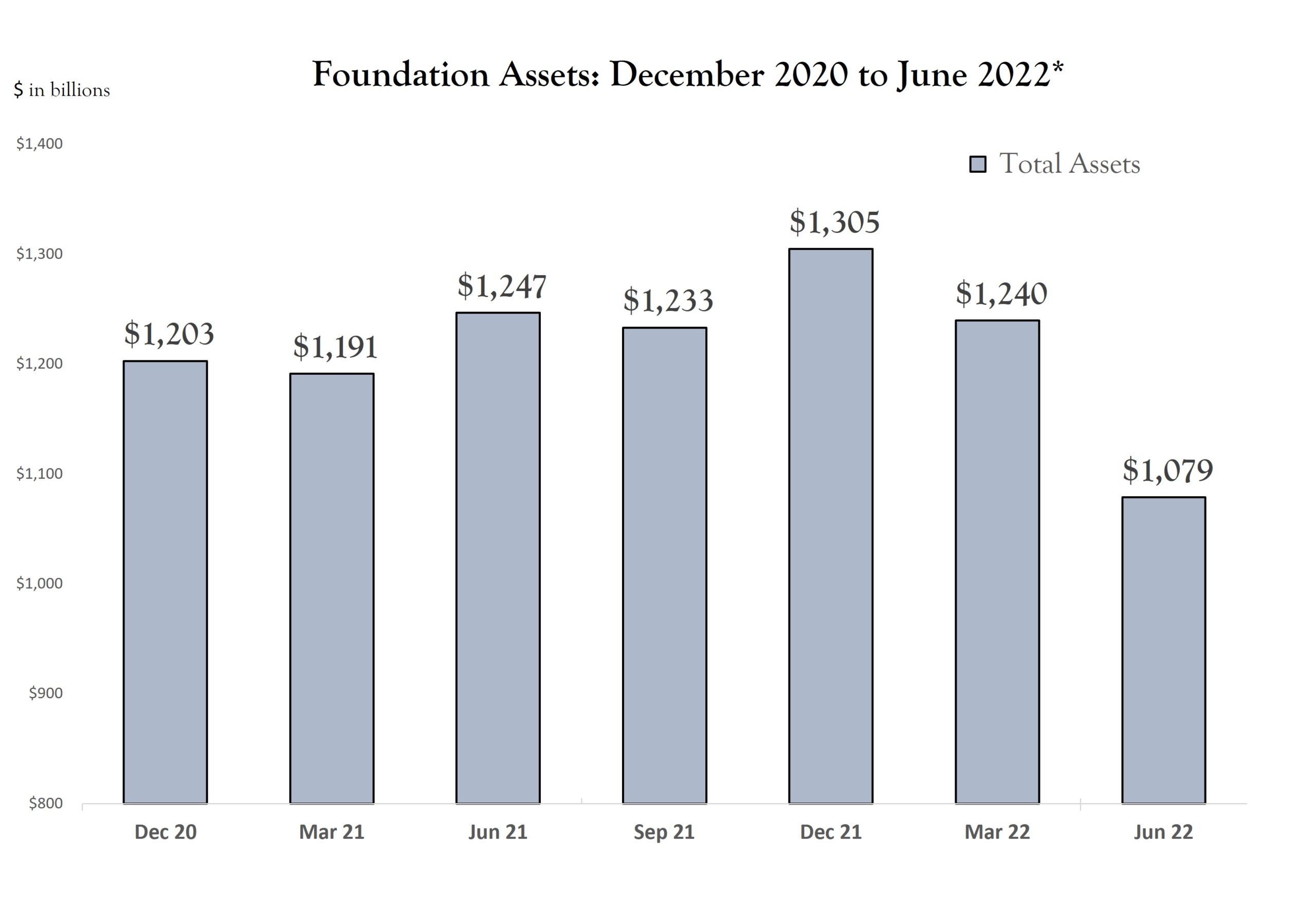

*The data in the chart above combines historic information drawn from foundations’ reported asset levels and disbursements obtained from their annual tax filings, along with projected values based on the FoundationMark Grantmaker Investment Value (“GIV”) Index which estimates monthly returns for the foundation universe based on reported asset allocations and market returns. Gifts, grants, and operating expenses projections are based on historic disbursement ranges.

FoundationMark models indicate that U.S. foundations’ assets fell $235 billion in the first half of 2022. The sharp downturn was fueled by global stock market weakness and falling bond prices.

Forecasting Giving - Where We are Today

While we won’t know the level of 2022 foundation giving until well after foundations have closed their books for the year (foundations are required to file a form annually with the IRS detailing the amounts and recipients of grants, but with a significant time lag), we can make an informed estimate on giving levels with two very important caveats.

- “If” Number 1: Asset levels remain at (or close to) current levels.

- Asset levels and grantmaking amounts go hand in hand, the higher the assets, the greater the giving and vice versa. Investment performance is by far the biggest variable in forecasting assets and by extension, grantmaking amounts. Clearly, it is impossible to peer into the future to see where financial markets end the year. Rather than take any kind of position on future investment performance, the default is to use current asset levels. So the first big “if” is the assumption that asset levels remain close to where they are now. If global equity markets improve, we would adjust the forecast higher, conversely if markets fall, so too would the grantmaking forecast.

- “If” Number 2: Giving as a percentage of assets stay in line with historical patterns, or about 8% of three year average assets.

- There is a common misconception that foundations distribute 5% of their assets each year. The 5% rule is that foundations must make qualifying disbursements of at least 5% of their average assets or risk losing their tax advantaged status. The reality is that foundations disburse about 8% of the three year rolling average assets. Link So the second “if” is the assumption that foundations will stick to their payout ratios. It bears noting that the variability of payout ratios is quite small historically, so this assumption is a relatively safe bet.

All Things Being Equal, Expect Giving about Flat

Despite the big negative market moves in the first half of the year, giving is expected to remain about the same in 2022 as 2021.