Footer

Are you a trustee?

Interested in a free FoundationMark report on your foundation’s investment performance? click here

Contact Details

E-Mail: info@FoundationAdvocate.com

By

Every month, FoundationAdvocate (“FA”) highlights a state by providing a brief overview of its foundations in terms of performance, fees, and asset allocation. Data on Pennsylvania foundations and other states can also be found at Top Ten. The opinions expressed are FA’s.

Pennsylvania Highlights

Overview

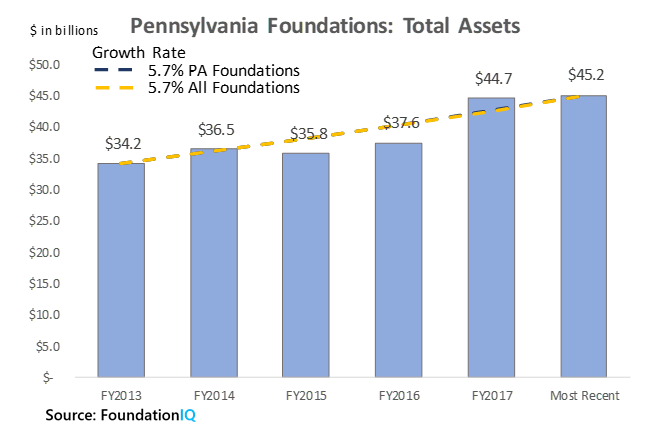

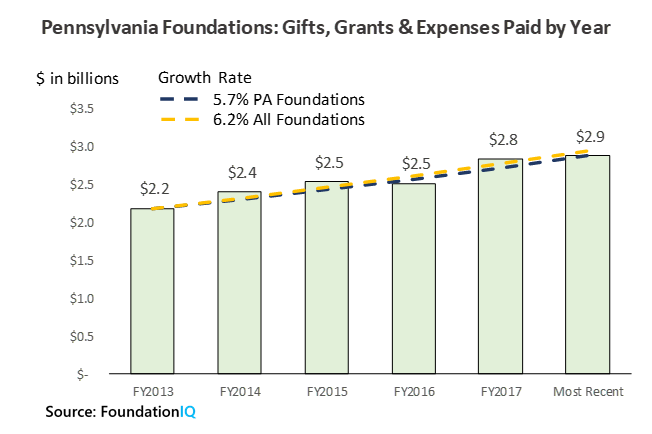

Pennsylvania foundations’ total asset growth of 5.7% per year since 2013 has been the prime driver behind a 5.2% per year increase in grants, gifts, and operating expenses paid over that same time frame.

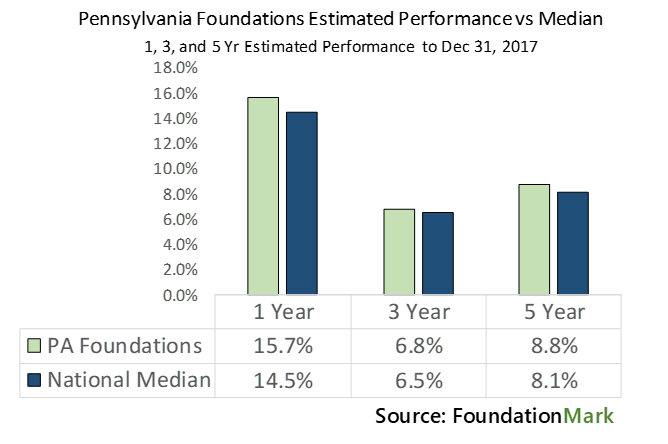

Pennsylvania foundations were among the best performers in the country in terms of investment performance for the 5-yr period ended December 31, 2017 (a 2018 update will be issued in the next several months), with 5-yr annualized returns of 8.8% versus the 8.1% national average for this period.

All data used in rankings and calculations is provided by FoundationMark and FoundationIQ and reflects foundations with over $1 million in assets.

The big picture is pretty straightforward, since foundations are required to pay out at least 5% of their assets each year (the actual average overall payout rate has been over 7% of average assets in the last several years). In order to maintain, or hopefully, increase support, foundations need to grow their assets faster then they are spending.

Therefor, there are a few key financial metrics that affect asset levels to keep an eye on.

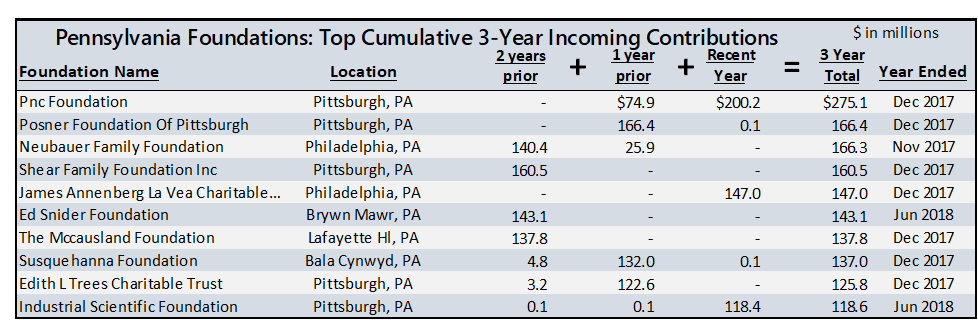

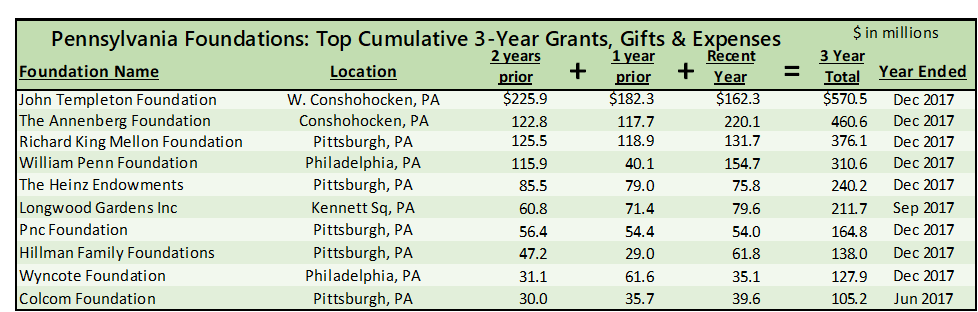

To a certain degree, money going out is set at a prescribed rate, incoming contributions can be unpredictable at best, which is why FoundationAdvocate focuses on the third metric, investment performance – which drives asset growth, and by extension, philanthropic support.

FA’s Bird’s Eye View provides readers with a big picture look at foundation investment performance at the state level using FoundationMark performance estimates, portfolio strategy classification, and star ratings. We believe that seeing foundations from an investment perspective will lead to better informed investment decisions which in turn may lead to improved performance.

Note: Unlike operating nonprofits such as schools and hospitals, private foundations typically have no outside revenue sources.Incom

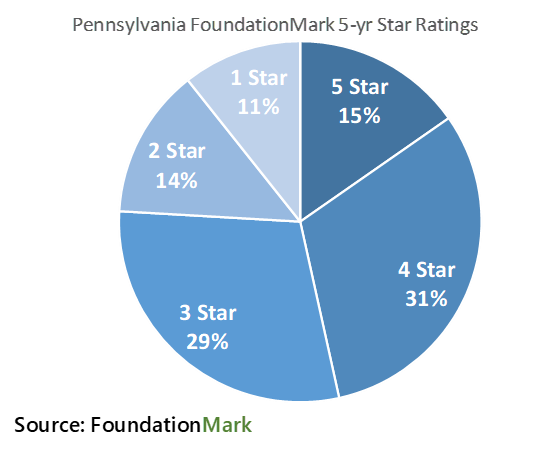

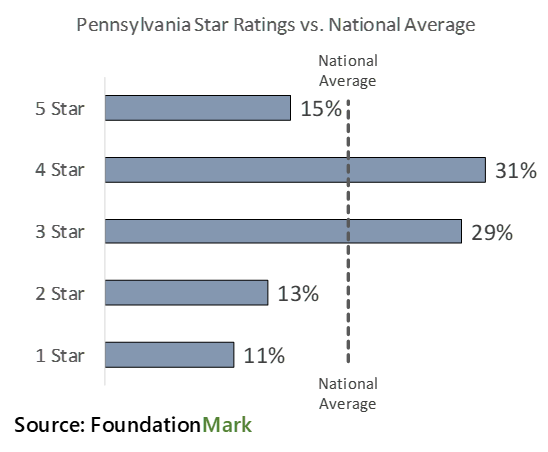

FoundationMark ranks foundations according to their estimated investment returns, foundations that place in the top 20% are rated 5 Stars, the next 20%, 4 Stars, and so on. As seen in the charts below, 15% of Pennsylvania foundations qualified for a 5 Star rating in the 5-yr period to December 31, 2017, lower than the national average of 20%, but when combined with the 31% with 4 Star ratings, brings the total to 46% in the outperforming groups. Only 24% of Pennsylvania foundations were in the lower performing 1 and 2 Star groups, versus 40% for the overall U.S. market. The average rating of 3.27 Stars exceeded the national average at 3.00.

Note: FoundationMark performance are net of disclosed investment expenses, therefor fees have a direct impact on performance estimates.

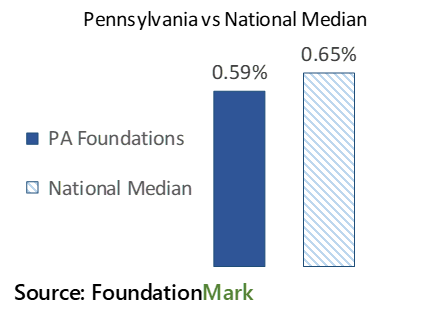

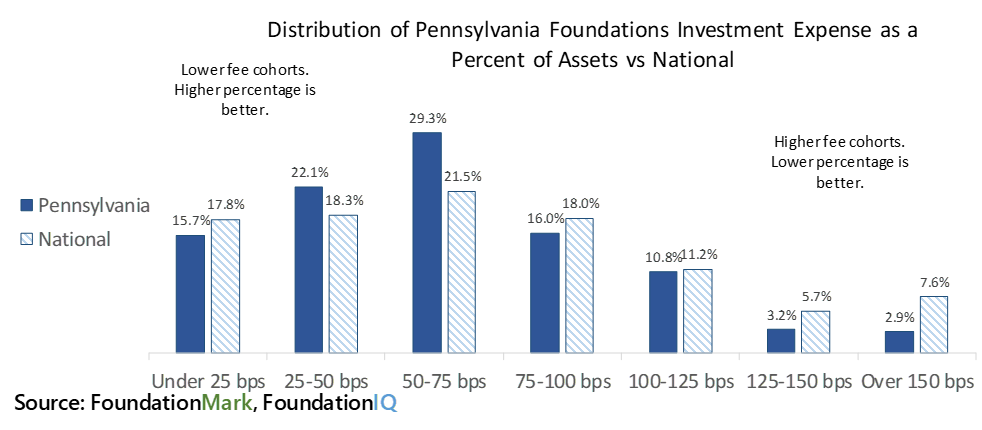

The chart below compares the percentage of Pennsylvania foundations by fee cohort with national percentiles.

In their most recently reported year, Pennsylvania foundations had higher percentages in the lower fee columns (those to the left) and a lower percentage in the higher fee columns (those on the right) compared to national averages.

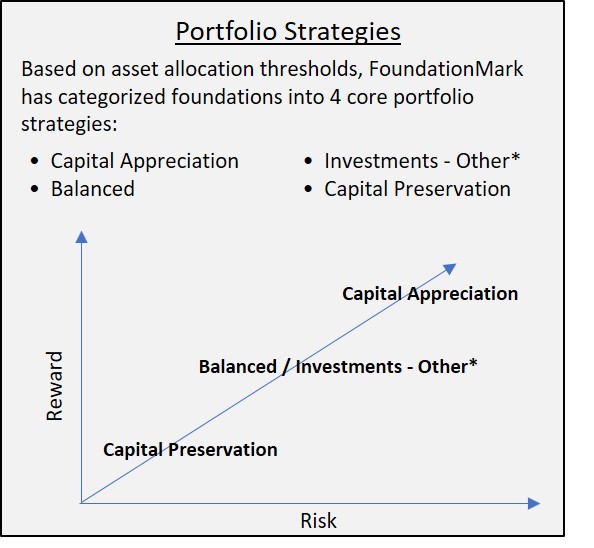

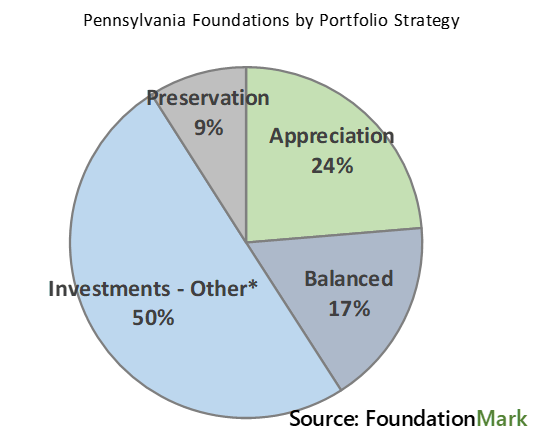

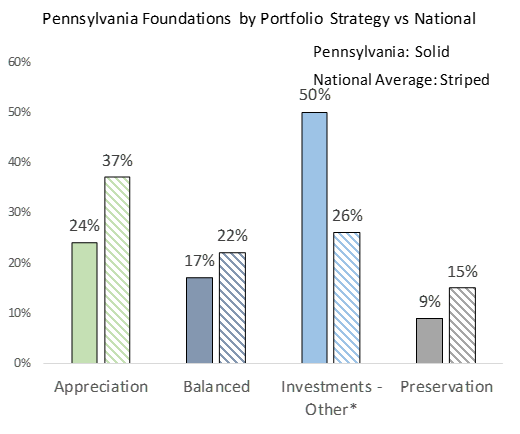

Asset allocation, and thus portfolio strategy, is typically a major determinant of investment performance, for example, foundations with a high exposure to equity markets (Capital Appreciation) are likely to have performance with a high correlation to equity markets.

The chart “Portfolio Strategies” graphically represents the inherent relationship between risk and reward as it pertains to investment strategies, where increased reward of an investment, i.e., its return, is accompanied by increased risk, i.e., volatility or risk of loss of principal. The level of investment risk in a portfolio can be hard to measure, especially without position level granularity, therefor FoundationMark groups portfolios into four categories explained below based on overall asset allocation in terms of risk (on the horizontal axis) and reward (on the vertical axis).

In summary, the four FoundationMark strategies are defined as follows:

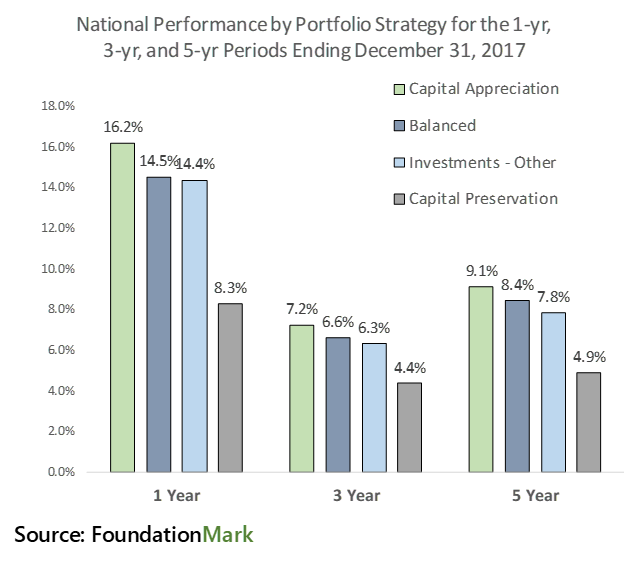

Strong global stock market performance over the five year period to December 31, 2017 propelled Capital Appreciation foundations to 9.1% average annual returns, while those with Capital Preservation portfolio allocations averaged just 4.9% per year. Balanced portfolios outperformed Investment – Others.

Pennsylvania’s strong median investment returns may be a function of a relatively small number, 9%, of foundations pursuing a Capital Preservation strategy, which had the weakest returns among the FoundationMark strategies for the period.

Pennsylvania Foundations’ Portfolio Strategies

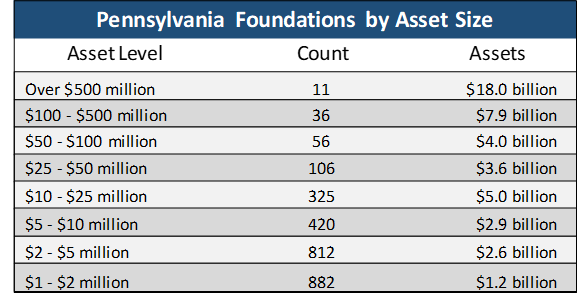

The table “Pennsylvania Foundations by Asset Size” provides the distribution of Pennsylvania foundations by asset level.

Close to 2,600 Pennsylvania foundations have assets exceeding $1 million.

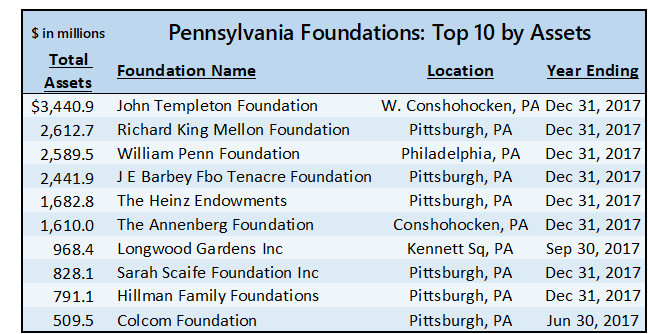

If you would like to learn more about the over 2,600 foundations in Pennsylvania that we follow, or the other 40,000 foundations outside of Pennsylvania that we also track, including performance and expense data, please visit our affiliated companies:

Interested in a free FoundationMark report on your foundation’s investment performance? click here

E-Mail: info@FoundationAdvocate.com