Footer

Are you a trustee?

Interested in a free FoundationMark report on your foundation’s investment performance? click here

Contact Details

E-Mail: info@FoundationAdvocate.com

By

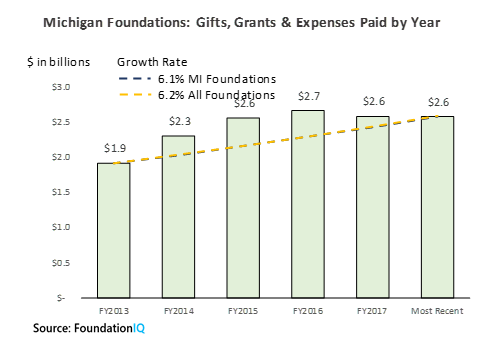

Every month, FoundationAdvocate (“FA”) highlights a state by providing a brief overview of its foundations in terms of performance, fees, and asset allocation. Data on Pennsylvania foundations and other states can also be found at Top Ten. The opinions expressed are FA’s.

Michigan Highlights

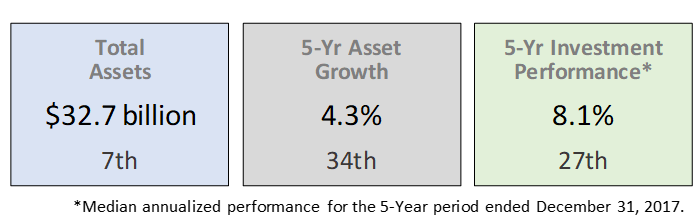

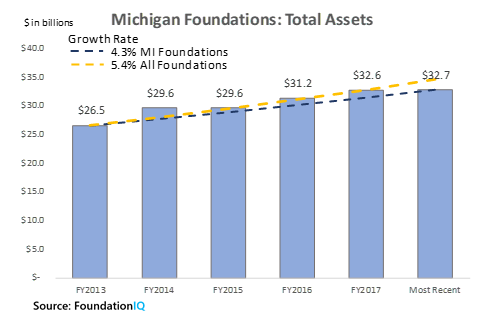

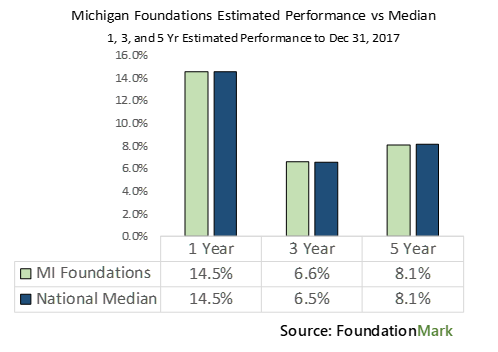

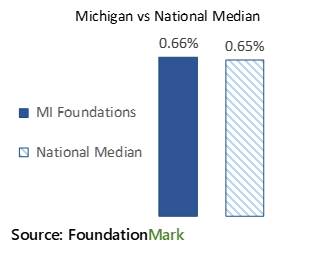

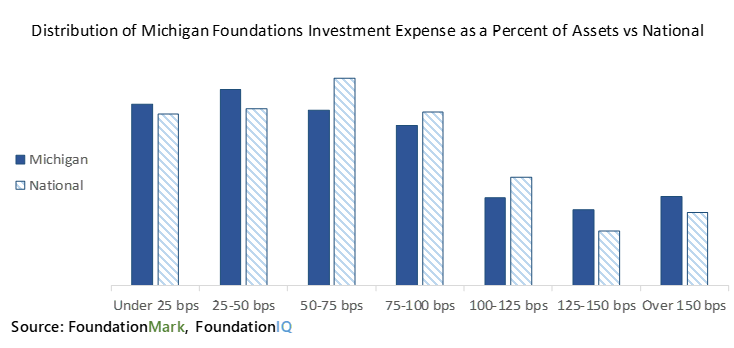

Michigan foundations represent a good cross-section of the overall market. In virtually every metric, Michigan foundations performed at or near national levels. 5-year investment performance was 8.1%, the same as overall median for the period ended December 31, 2017 Disclosed investment expenses of 66 basis points were also in-line with just a 1 basis point difference, to the national median of 65 basis

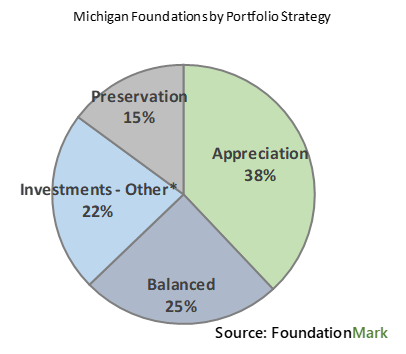

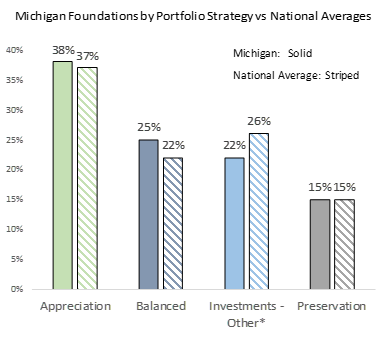

One reason that Michigan foundations may be performing at the national average is that the portfolio strategy percentages are similar to the overall, with a slight preference for Balance portfolios.

All data used in rankings and calculations is provided by FoundationMark and FoundationIQ and reflects foundations with over $1 million in assets.

The chart below shows that Michigan had a little more variations in fees than the national average as Michigan had a higher percentage in the two lowest fee groupings (on the left) as well as greater percentages paying higher fees (on the right).

Basis Points (bps): Investment fees are usually quoted as a percentage of assets. For example an investment manager may charge a 0.75% fee to manage the money that you have with the firm. The term ‘basis point’ is an easier way to say small numbers by moving the decimal point two places to the right. so 0.75% = 75 basis points, for the simple reason it is easier to say out loud “seventy five basis points” than “zero point seven five percent”.

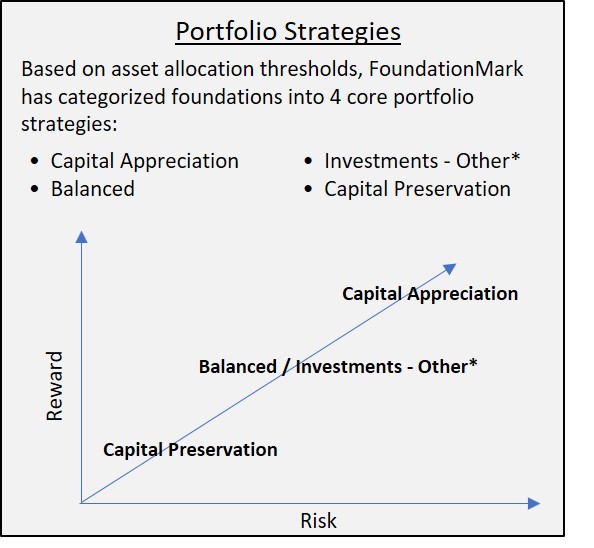

FoundationMark Portfolio Strategies

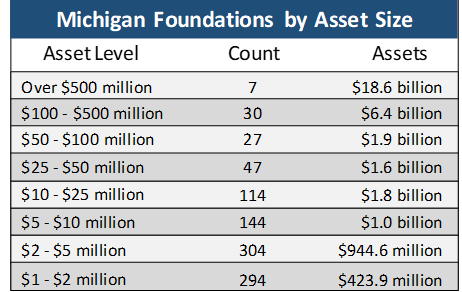

There are about 1,000 Michigan foundations with assets over $1 million.

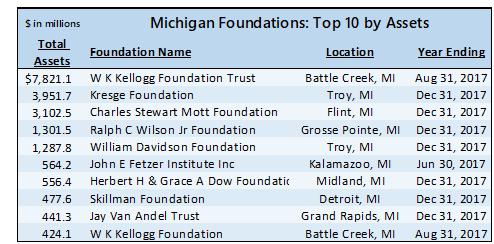

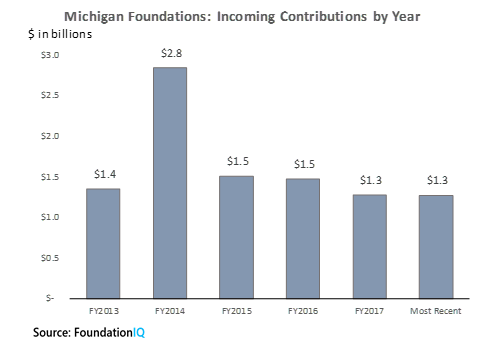

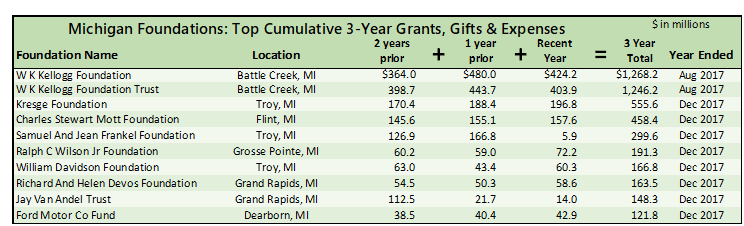

Note: Giving sums are inflated due to Kellogg Foundation Trust’s pass-through to Kellogg Foundation.

If you would like to learn more about the over 960 foundations in Michigan that we track, or the over 40,000 outside of Michigan we follow, including performance and expense data, please visit our affiliated companies:

Interested in a free FoundationMark report on your foundation’s investment performance? click here

E-Mail: info@FoundationAdvocate.com