By

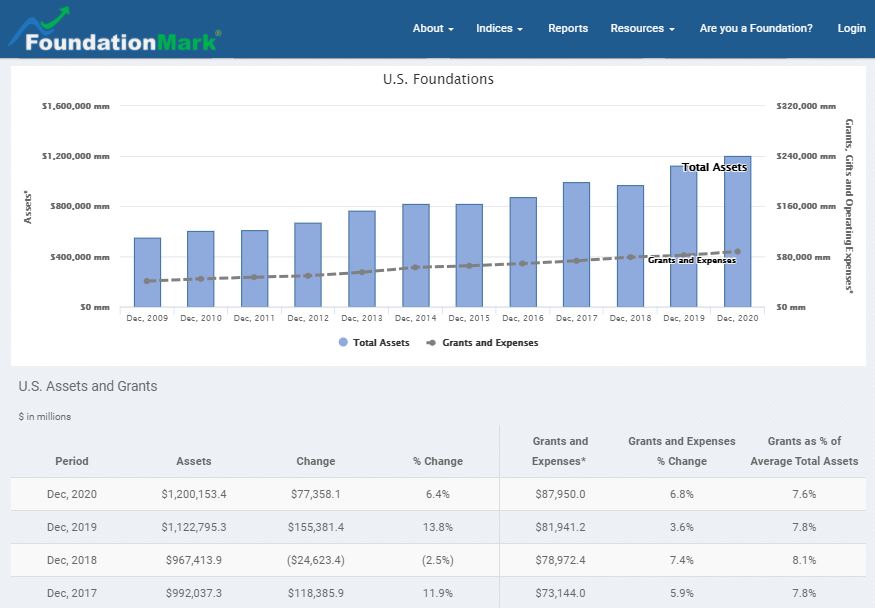

The latest estimates from FoundationMark indicate that foundations cracked the $1.2 trillion mark in total assets just 2 years after breaking through the $1 trillion threshold.

Strong equity markets in 2019 and 2020 fueled the growth in assets allowing foundations to increase giving by 15% over the past two years according to FoundationMark’s estimates.

Underlying Assumptions

*Investment performance is drawn from the FoundationMark GIV Index, Giving is total grants and operating expenses using an 8% of 3-year rolling asset levels payout rate, Incoming Contributions estimate is based on historic levels ($30 – $60 billion over last 10 years).

The 12 year bull market in U.S. stocks has fueled foundation asset growth and in turn philanthropic support.

It bears noting that in the past decade, giving has nearly doubled, from $47 billion a year in 2011 to an estimated $88 billion last year, an increase of about 6.5% per year, roughly in line with investment performance of an estimated 7.6% over the period.

The long term perspective emphasizes the fundamental relationship between giving and investment performance, or put more bluntly, the better a job foundations do managing their assets, the more money they can give to operating charities.

Interested in a free FoundationMark report on your foundation’s investment performance? click here

E-Mail: info@FoundationAdvocate.com