By

One of the most basic concepts in portfolio management is that asset allocation typically determines the lion’s share of investment returns. If your portfolio is mostly U.S. stocks, it will probably perform similarly to the stock market indices (assuming a diversified portfolio), alternatively if your portfolio has a significant weight in bonds, it will probably skew to fixed income returns, or if you have a pile of cash, it probably won’t do much.

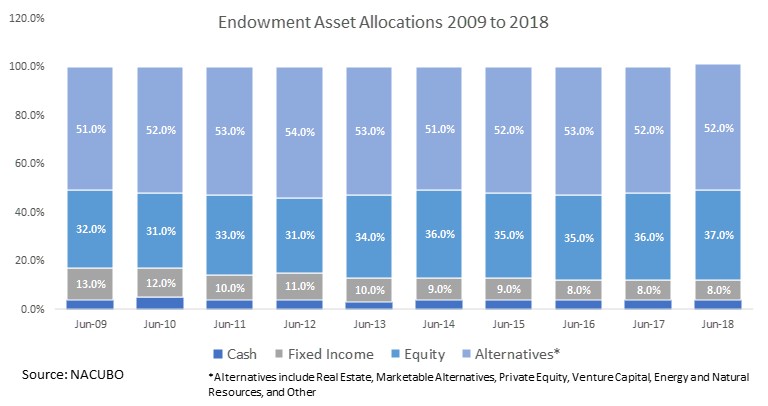

Foundations’ portfolios are no different. Understanding how they are invested might provide insights into performance.

Our affiliate, FoundationMark, tracks allocation and found that

Interested in a free FoundationMark report on your foundation’s investment performance? click here

E-Mail: info@FoundationAdvocate.com