Foundation Portfolios Up 5.2% in 3rd Quarter

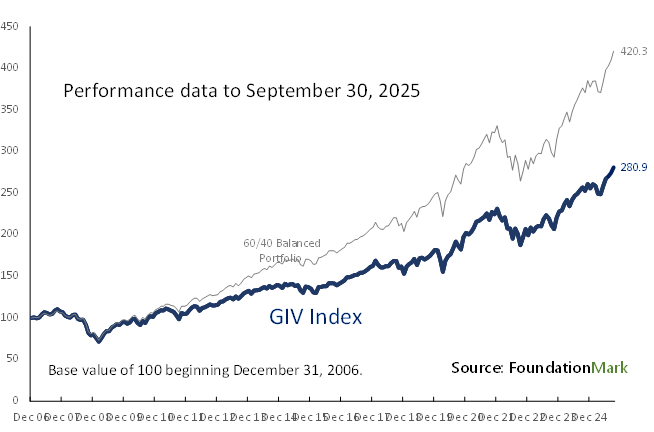

The Grantmaker Investment Value Index (“GIV”) rose 5.2% in the second quarter, bringing year-to-date gains to 9.9%. The GIV Index stood at a record high as of September 30, 2025 with 10-year returns annualized at 8.0%. However, foundations continue to lag the traditional institutional portfolio mix comprised of 60% in the S&P 500 and 40% in the Bloomberg Aggregate Index which posted annual gains of 10.0% for the decade ended September 2025.

In the third quarter, U.S. equity markets posted very strong gains 2025 with the S&P 500 up 8.1% to bring year-to- date performance to 14.8%. International developed markets had another good quarter, up 4.8% bringing the year-to-date gain to a very impressive 25.1%. Emerging markets also posted large gains in the quarter, up 10.0%, bringing year-to-date performance to 27.5%.

Despite foreign markets outperforming the U.S. so far in 2025. over the long term, international and emerging markets have trailed the U.S. by a significant margin. Over the last decade, the S&P 500 has returned 15.3% annually compared to international and emerging markets, which were up 6.5% and 4.8% respectively.

U.S. high grade bonds were steady, gaining 2.0% for the quarter and 6.1% year-to-date. High yield bonds returned 2.5% for the quarter and 7.2% year-to-date. Over the past ten years, high grade bonds have only returned 1.8% annually, less than cash at 2.0% per year.

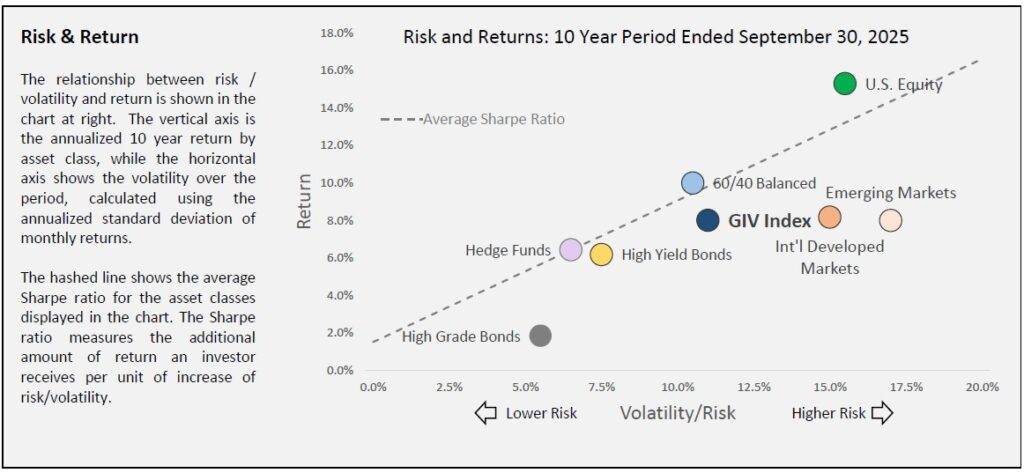

Risk and Return

The chart below shows the relationship between risk and return. In the chart, risk is defined as volatility (shown on the x-axis) and return is plotted on the y-axis. Asset classes out to the right (International and Emerging Markets) are more volatile than those closer to the axis (High Grade Bonds). As one can see, over the 10-year period, U.S. Equities were the strongest performer, up 15.3% (y-axis). The dotted line shows an approximation of the average Sharpe ratio which is a measure of risk weighted return. Asset classes above the line delivered better risk/return than those below. U.S. Equity was the only significant outlier over the period (which also drove the 60/40), with Hedge Funds approaching the average line.

The GIV Index’s position, below and right of the 60/40 Portfolio indicates that foundations took more risk for less return than the passive 60/40 mix.

As one can see High Grade Bonds was the worst asset class by a long way and a poor asset allocation choice for the decade, with annualized returns of just 1.8%, investors would have been better off in cash. Foundations have returned about the same amount as international markets, but with lower risk.

Over the 10-year period to September 2025, U.S. Equities delivered nearly double the return of international stocks cumulatively with a similar risk profile.

The FoundationMark GIV Index is calculated using FoundationMark return estimates up to and including December 2024 thereafter monthly returns are estimated based on reported asset allocations and market returns. The GIV Index serves as a proxy for foundation performance. Actual performance may differ materially. The GIV Index is updated on a continuing basis and all data is subject to revision.

The 60/40 Balanced Portfolio represents the traditional institutional allocation to equities and fixed income with weightings of 60% in the S&P 500 and 40% in the Bloomberg U.S. Aggregate Index, rebalanced monthly.