Footer

Are you a trustee?

Interested in a free FoundationMark report on your foundation’s investment performance? click here

Contact Details

E-Mail: info@FoundationAdvocate.com

By

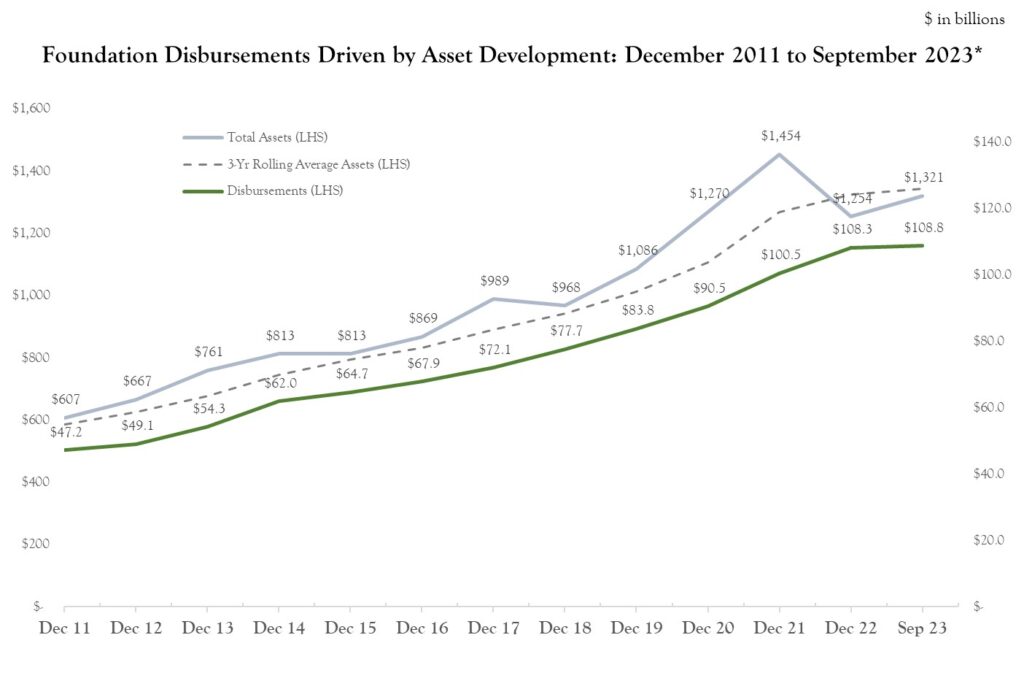

Asset levels reached a record approaching $1.5 trillion at the end of 2021 but dropped by $200 billion through December 2022. Year-to-date 2023 has seen an uptick in financial markets leading to about a 5% gain in estimated asset levels through September.

Based on the two important caveats (see box) regarding asset levels and payout ratios that we highlight, we expect foundation disbursements to rise slightly to $108 billion in 2023.

Two Important Caveats

Disbursement amounts are based on two variables, 1) Asset Value, and 2) Payout Ratio.

*Annual giving levels shown above reflects total grants, gifts, and operating expenses as reported by private foundation in their 990-PF filings. There is a time lag between foundations year-end and when their tax filings are released to the public. Data for 2022 is preliminary and data for 2023 is forecasted based on the assumptions detailed below.

As you can see in the graph below, there is a very high correlation between asset levels (light blue line) and disbursement levels (green line). Furthermore, one can see that while both assets and disbursements have shown significant growth over the period, asset levels tend to fluctuate more than disbursement levels, which is understandable as asset levels are subject to financial market moves. One reason for the lower volatility of disbursement levels is that many large foundations (which also represent a major proportion of charitable support) use a three year rolling average of assets when budgeting their grantmaking programs. The dotted line shows the three year average asset levels. The correlation coefficient between the three year average and disbursements is over 99%.

While we won’t know for sure the level of 2023 foundation giving until well after foundations have closed their books for the year, filed their 990-PF forms, and the IRS releases the data, we believe that operating charities should expect giving from foundations to be about the same in 2023 (see caveats above) as in 2022.

The term “giving” is never mentioned in the IRS Form 990 PF, which is the source data for all our financial reporting, estimates, and projections. Instead, the tax form requires that foundations report their “Total Operating and Administrative Expenses” and “Total Grants, and Gifts Paid” – the total of these two lines is “Total Disbursements”. In another place on the tax form, foundations must report “Disbursements for Charitable Purposes”, which one might refer to as “giving” since it represents the amount, either in grants or expenses, that count toward the 5% payout requirement.

We refer to disbursements in this note as it provided the most comprehensive picture of foundation outlays. Historically, total “Disbursements for Charitable Purposes” is about 90% of “Total Disbursements”.

Interested in a free FoundationMark report on your foundation’s investment performance? click here

E-Mail: info@FoundationAdvocate.com