As Go Assets, So Go Disbursements

Intuitively, it makes perfect sense that foundations’ disbursements are a function of their asset levels. After all, the the 5% mandated payout ratio ties disbursements to assets. Despite this fundamental relationship, we believe that attention to foundation’s assets are too often overlooked, as new contributions and highly publicized grants get more headlines.

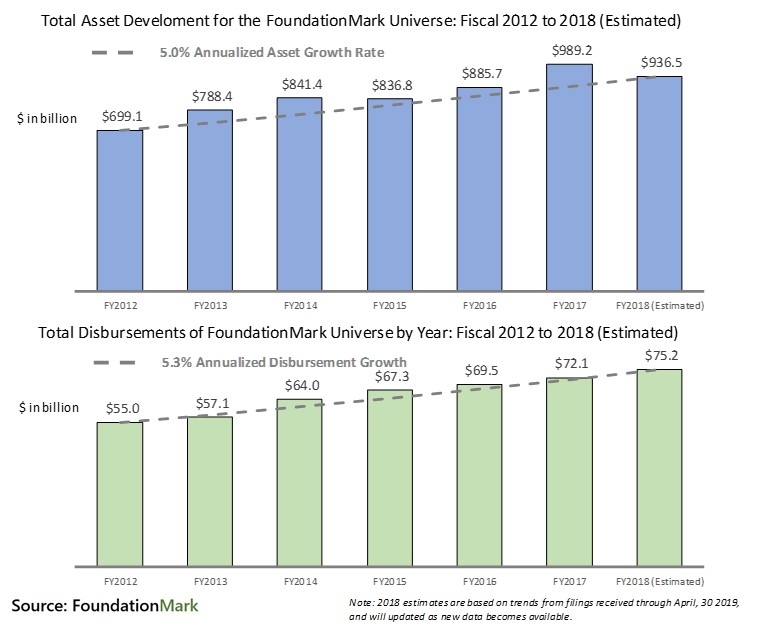

As seen in the charts below, there is a strong correlation between asset growth and disbursement growth over time. Grants, gifts and operating expenses follow asset levels albeit with a bit of a time lag and some “smoothing” – after all foundations, especially larger ones, think in multi-year grants and projects and don’t want whip funding around, so they typically use some version of a 3 year rolling average of assets when planning grant making.

Over the period, total assets grew at a 5.0% annual pace while disbursements grew a little faster at 5.3% per year. Another way to look at it is that assets grew by over a third from about $700 billion to an estimated $937 billion at the end of 2018, while annual disbursements increased from $55 billion to over $75 billion, or up about 37% since 2012.

How Can We Grow Grant Making? Grow Assets

Since disbursement levels are based on asset levels, the algebra involved in growing disbursements is very simple, if you want higher support levels from foundations, they need to grow their assets faster than they spend. As you can see from the charts above, in aggregate foundations contribute substantially more than the mandated 5% of assets per year, for example 2017’s $72.1 billion of disbursements represented 8.1% of beginning assets of $885.7 billion. This 8% plus rate of grant making and expenses has been fairly consistent over this period.

As we mentioned, there are just two places to look for asset growth – incoming contributions and investment returns. Therefor it follows that the combination of money coming and and investment returns must must be greater than 8% in order to grow assets and by extension, disbursements.

A combination of factors such as strong U.S. equity markets, tax law changes, and the Gates/Buffett Giving Pledge have provided a large source of incoming contributions over the past several years, but these gifts can be episodic as most foundations are started with a single large contribution – often as a condition of a will, or after a major liquidity event like a company’s sale.

Unlike incoming contributions, investment returns are the bread and butter of foundation asset growth. In order to ensure long term philanthropic growth, foundations need their investment returns to not only keep up with, but surpass their grant making. At FoundationAdvocate and our affiliate FoundationMark, we are dedicated to tracking performance to keep foundations informed and enable them to evaluate their performance in the context of their peers.