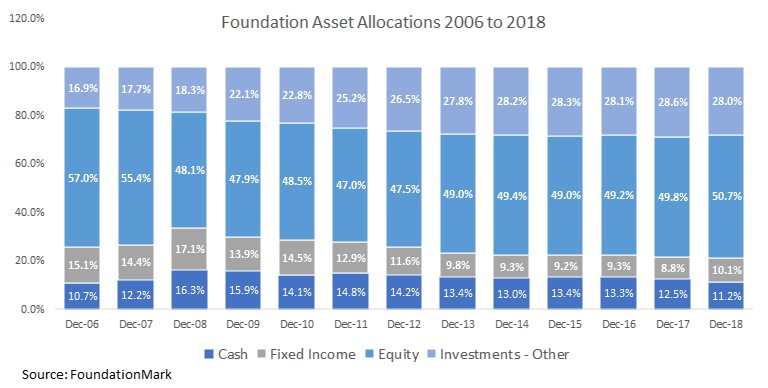

The chart above shows that foundation asset allocation hasn’t varied much year to year. Two long term trends have been a reduction in cash and fixed income holdings and an increase in “Investments – Other”. The category “Investments – Other” is a specific line on the foundation’s annual filing. The underlying assets may include alternative assets such as private equity and hedge funds.

Overall, foundations typically have had 20-30% in cash and bonds, and 70-80% in equities and “Investments – Other”.

Throughout the financial crisis in 2008, one may observe that defensive asset classes, cash and fixed income, increased to a combined 33.4% from 26.6% in 2007, which may lead one to think that foundation portfolio managers reduced risk. Another explanation is that the 2008 change was purely the result of lower equity asset values. For example, imagine a $1 million portfolio at the start of a year, 1/2 in stock 1/2 in bonds so 50 / 50 allocation. If the value of the stock portfolio dropped 50%, with bonds staying flat, the portfolio would be worth $750,000 with $250,000 in stock and the same $500,000 in bonds. The end of year allocation would be 33.3% in equities, 66.7% in bonds.

Endowments Don't Change Much Either

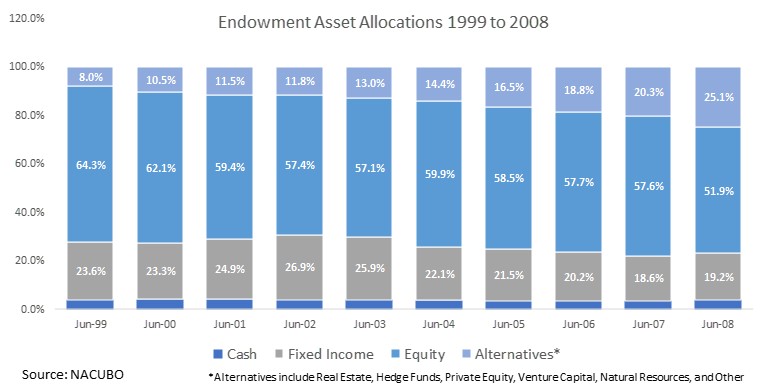

Similarly to foundations, college endowments’ asset allocation have shown very little short term variation as seen below.

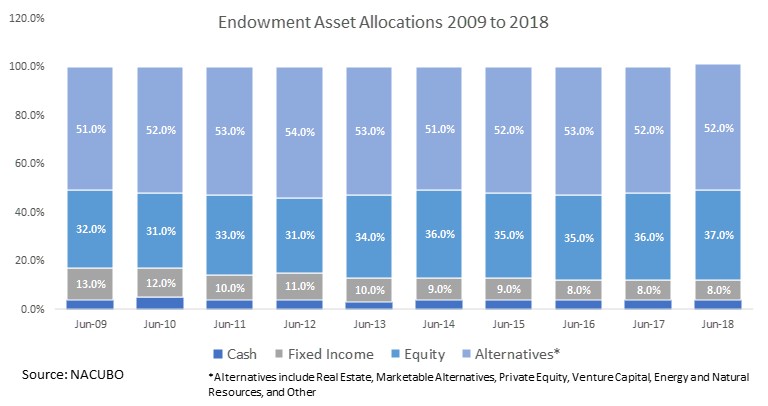

The data above and below come from NACUBO, which tracks college endowment performance (link), For ease of comparison, we put all public equities (U.S., International, and Emerging Markets) into “Equity”, similarly we grouped assets such as hedge funds and private equity into alternatives.

NACUBO altered its asset categories a bit after 2008, but the data below shows a continuation of the core trends away from public markets to more alternatives.

Important note: The chart above uses equal weights, while the chart below is dollar weighted.

Why Don't Institutional Asset Allocations Change Much

First and foremost, it is important to bear in mind that the data in the asset allocation charts above represents aggregate data, which means that individual foundations or endowments may have vastly different allocations and may change strategies more quickly.

Some reasons that allocations don’t change include:

- Redemption periods for alternative assets: The more alternatives, the lower the ability to maneuver

- Some asset classes like private equity, venture capital, and real estate typically cannot be sold, except in secondary markets which usually entails a sharp discount.

- Hedge funds usually offer monthly, quarterly, or annual redemption periods, and can put up “gates” if redemption levels are too high.

- Benchmarks and investment policy statements: Many institutions have formal investment policy statements with thresholds for asset classes which limit maneuverability.

- Portfolio managers are smart, not brave, so if for example the investment policy statement calls for an emerging market weight of 5-15%, it is a very safe bet that the manager will steer toward the middle of the lane.

- Benchmarks have a similar effect on manager behavior, particularly if a manager’s compensation is tied to a benchmark.

- Historic holdings. There is a subset of foundations that were established with stock grants that continue to be the lion’s share of their assets.

- The second largest foundation in the U.S. is the $15 billion (Dec 2018 value) Lilly Endowment, which consists virtually entirely of Eli Lilly & Co stock. Others, like the Woodruff Foundation is invested almost completely in Coca-Cola stock.

- Allocation numbers represent aggregate values: As asset prices gyrate, one investor might see value where another sees risk.

- Imagine a scenario in which one foundation buys shares in a company that another foundation was selling, in aggregate, their combined allocation would stay the same.

The discussion above is intended to be more explanatory than critical. Foundations can have very good reasons for maintaining their asset allocations through volatile markets. In fact one could argue that volatile markets provide the ultimate test of a portfolio manager’s conviction. However, we would point out that there is a distinction between conviction and complacency, and foundation trustees should be actively engaged with their foundation’s financial oversight at all times.