Disclosure Spectrum

Foundations are required to report the fair market value of their assets every year. The IRS further requires foundations to list their holdings by asset class on their balance sheet and provide schedules of their holdings, however, foundations interpretations of “additional detail” can vary enormously. Some foundations provide extensive lists of individual security holdings, or fund holdings, others reference custodial accounts with managers, some detail asset class subcategories, and still others provide the bare minimum to comply with the disclosure requirements.

What's Required

As a starting point, fair market value is the most important disclosure requirement. The main condition for tax exemption is that foundations must distribute 5% of their assets every year. Without a fair market value, one couldn’t calculate how much a foundation would need to distribute to satisfy the payout rule. Therefor the IRS needs the fair market value as a component of the calculations to verify that a foundation is living up to its end of the bargain.

Foundations are required to submit a balance sheet listing values of asset classes such as cash, stocks, and bonds (bonds are split into corporates and government classes). Investment assets that fall outside the traditional classes are typically reported in the catch-all category “Investments – Other”, which is where hedge funds, private equity, venture capital, and more investment vehicles reside.

"Required" but Often Ignored

Foundations are instructed to “attach a schedule listing and describing each of these investments held at the end of the year”, but what accounts for a “schedule” can vary considerably. Some foundations list their holdings all the way down to the security level – for example exactly how many shares of which stock they own. Other foundations simply don’t reveal anything beyond the value of their holdings. Foundations seem to have a great deal of leeway in the level of disclosure on their assets.

“Investments – Other” accounts for about 40% or nearly $500 billion dollars of total foundation assets. Not all of these billions are in “alternative assets”, as some foundations include mutual funds or other public investments into “Investments – Other”, and still others “kitchen sink” the disclosure and simply list everything in the category.

It bears noting that foundations that are invested in partnerships such as hedge funds or private equity cannot get to the security level of granularity as the the underlying positions in the funds aren’t always disclosed, and even if they were it would be reporting nightmare – just imagine how a foundation would report a hedge fund’s short position.

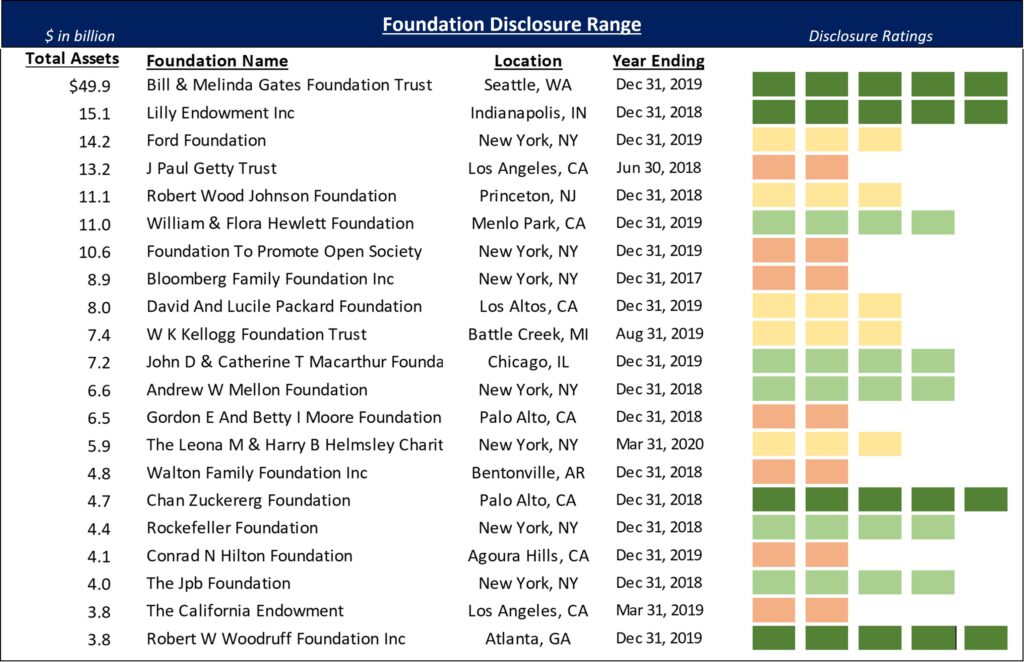

Top Foundations Holding Transparency

As one can see from the table above, even top foundations’ holdings disclosure can vary a great deal. Gates, Lilly, Chan Zuckerberg, and Woodruff are the most transparent, while Getty, Bloomberg, Walton, and others are considerably more opaque.